“No Pain in Claim with Zurich Call” – Our Success Story with Zurich Insurance

Check out our Success Story with Zurich Insurance about “No Pain in Claim with Zurich Call” 😉

Zurich Insurance, headquartered in Zurich, Switzerland, stands as one of the world’s largest and leading global insurance companies. Renowned for its dedication to delivering innovative and personalized insurance solutions, Zurich Insurance consistently aims to enhance the customer experience through cutting-edge solutions.

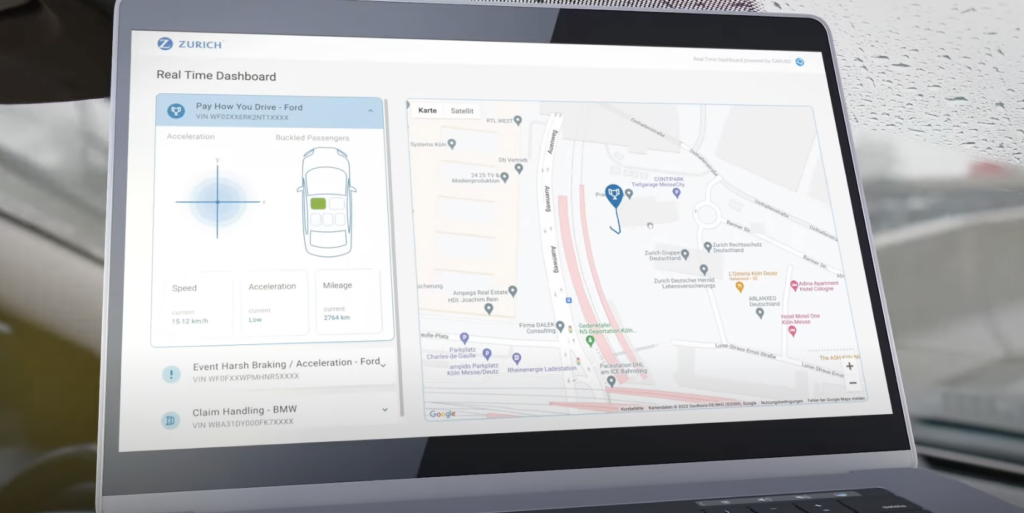

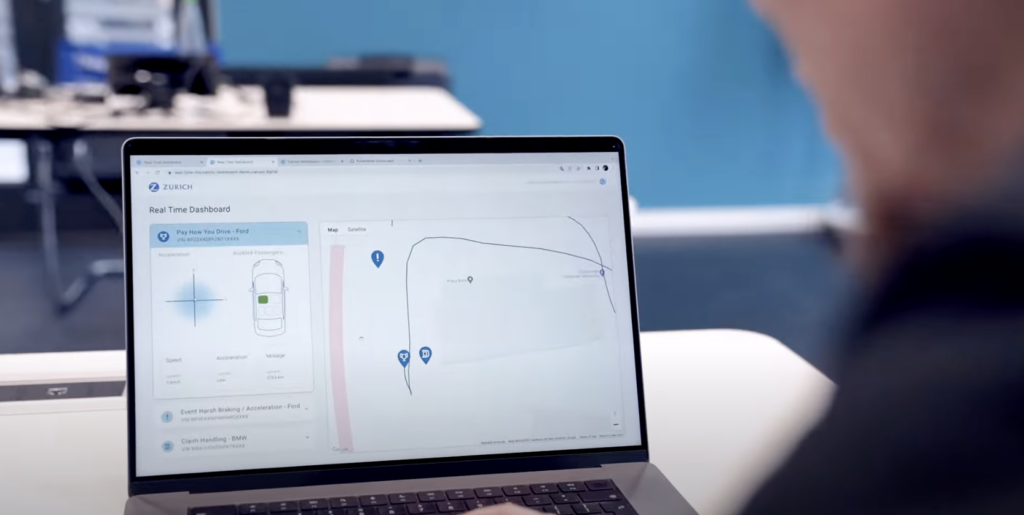

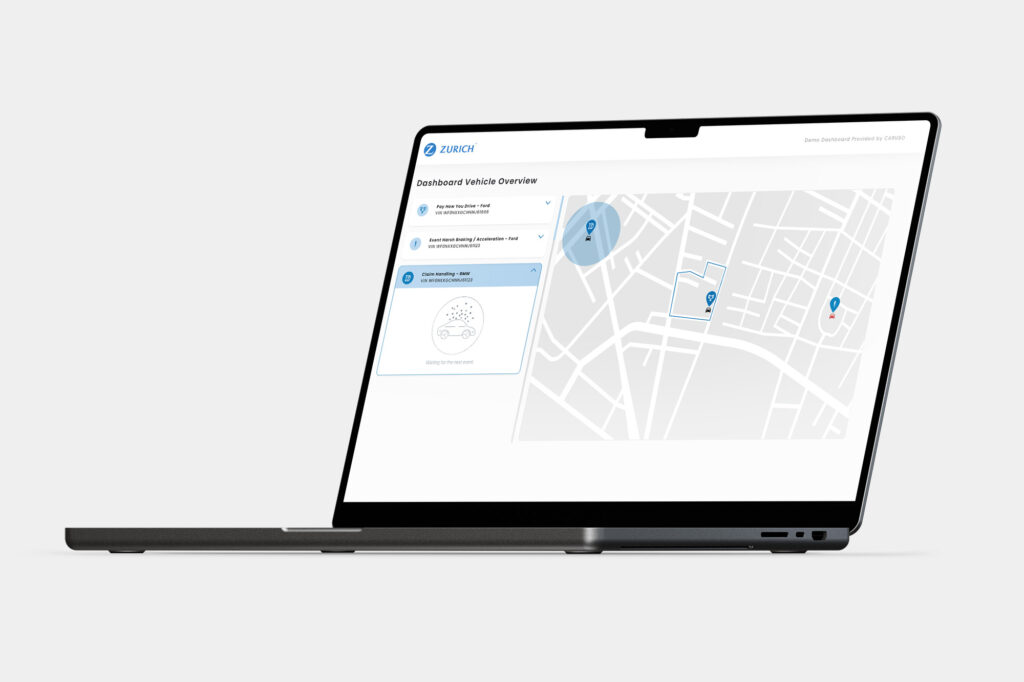

Acknowledging the challenges customers encounter during the claims process, Zurich Insurance has integrated CARUSO’s standardized multi-brand connected car data to refine and elevate its claims management approach. The filing of a claim often involves navigating a complex maze of steps, paperwork, and documentation, leading to customer frustration and dissatisfaction due to a lack of clear information.

CARUSO’s technology empowers Zurich Insurance to swiftly validate claims, offer precise damage estimates, and improve overall claims efficiency. This strategic adoption of Connected Car Data signifies the initiation of Zurich’s commitment to innovation within the insurance landscape.

Customer feedback has emphasized the need for more frequent updates and transparent communication during the claims process. Zurich Insurance recognizes this necessity and understands that clear communication and timely updates contribute significantly to customer satisfaction.

Connected car data proves to be pivotal in the First Loss Notification process, providing real-time insights into incidents such as speed, impact direction, and collision severity. This data enables Zurich to promptly assess claim validity, provide timely damage estimates, and expedite claims decisions, ensuring a more informed and supported experience for policyholders.

Zurich Insurance firmly believes that leveraging connected car data is critical to enhancing its auto claims business and delivering added value to customers. Real-time insights into accident scenarios contribute to more accurate claims assessments, fraud detection, and a personalized service approach, ultimately resulting in an improved overall customer experience.

Through the integration of artificial intelligence and data analysis, Zurich Insurance optimizes its claims processes, ensuring a more efficient and hassle-free experience for customers. Utilizing connected car data not only accelerates claims processing times but also leads to cost savings for Zurich, resulting in prompt payouts and heightened customer satisfaction.